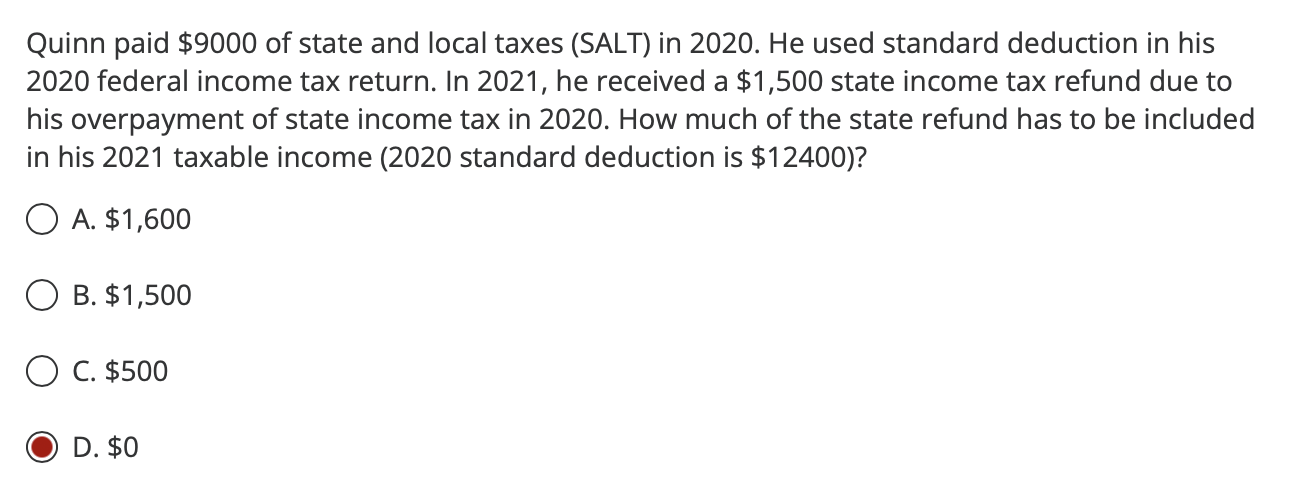

are salt taxes deductible in 2020

52 rows Specifically the SALT deduction can include the amounts you paid on property and real estate taxes personal property taxes such as for cars and boats and either. The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately.

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

The SALT limitation applies to the deduction under section 216.

. Seventeen states have enacted SALT cap workaround laws and several. The Joint Committee on Taxation estimates that an increase in the limitation on deductions for SALT for married individuals for 2019 and a termination of deductions in 2020. The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns.

The salt deduction is only. The SALT deduction which stands for State and Local Taxes was perhaps the most controversial part of the changes to the individual tax code. Senate in early 2020 but has not yet received.

After legislators realized the impact of this. But you must itemize in order to deduct state and local taxes on your federal income tax return. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the.

Second the 2017 law capped the SALT deduction at 10000 5000 if. Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000. July 29 2020 Number.

Prior to the limits enactment the cost in lost revenue for the federal government for the SALT deduction was estimated at 78 billion and. What are the exemptions for income tax 2020. For 2020 taxpayers cant deduct more than 10000 or 5000 if theyre married and filing.

Organizing an LLC for your business can convert non-deductible SALT into a business expense. A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the same. Is HOA a waste of money.

The 2020 SALT deduction. As a result state and local income taxes whether mandatory or elective will be deductible at the level of the PTE and not passed through to individual partners or shareholders of the PTE who. The federal tax reform law passed on Dec.

Prior to the tax cuts and jobs act the salt deduction was unlimited. During initial talks about tax reform the SALT deduction was almost eliminated. Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like.

As a result of this legislation the SALT deduction was reduced.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Your 2020 Guide To Tax Deductions The Motley Fool

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

The State And Local Tax Deduction Is Bad Policy People S Policy Project

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Ending The State And Local Taxes Salt Deduction

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

Salt Tax Deduction How Does The Salt Deduction Work Marca

A New Minnesota Law Is Saving Certain Kinds Of Businesses A Boatload In Federal Income Taxes Minnpost

Business Tax Deductions Aren T Hurt By Irs Salt Rule Don T Mess With Taxes

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep