limited pay life policy coverage

If purchased early enough in life theyll help you avoid. A limited pay life insurance policy allows you to pay your insurance premiums in full within a certain time frame.

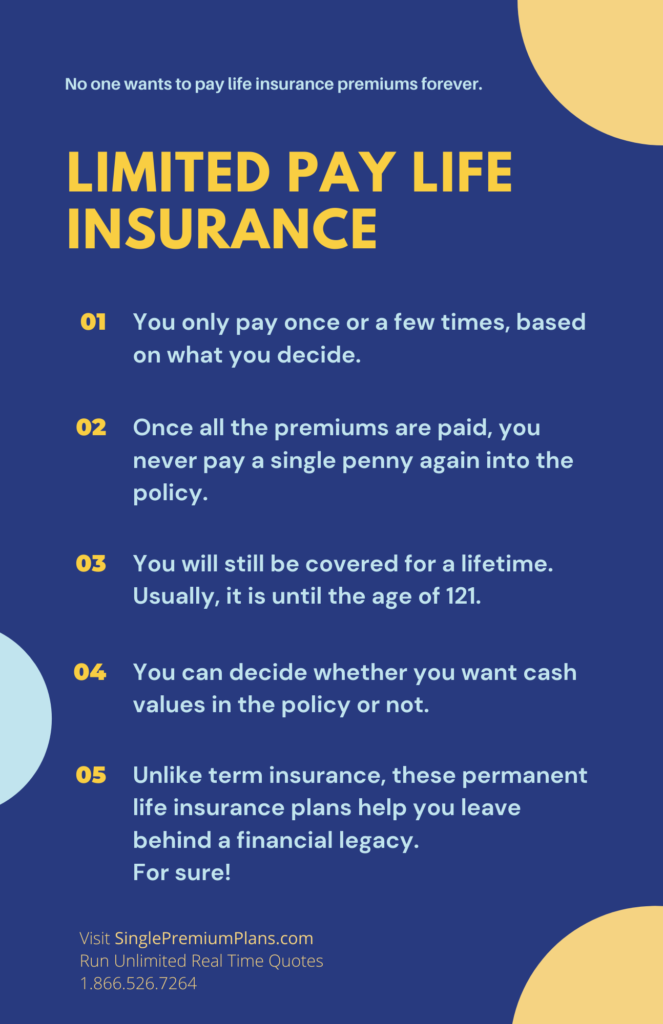

Limited Pay Life Insurance Everything You Need To Know

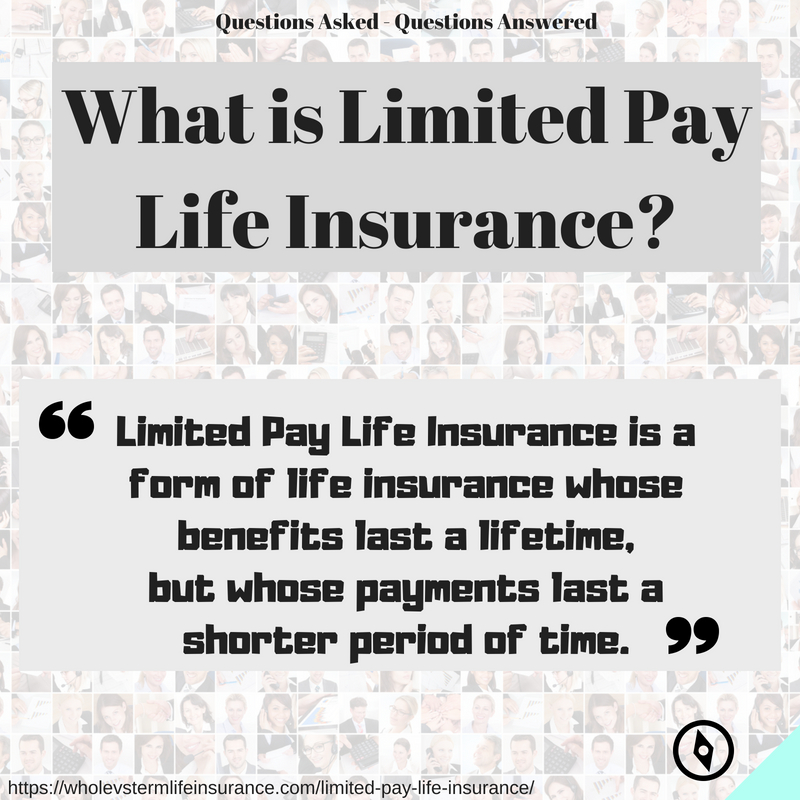

What is a Limited Pay Life Insurance Policy.

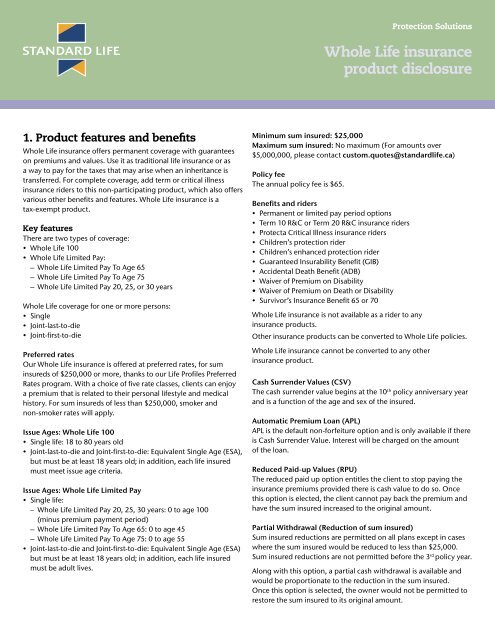

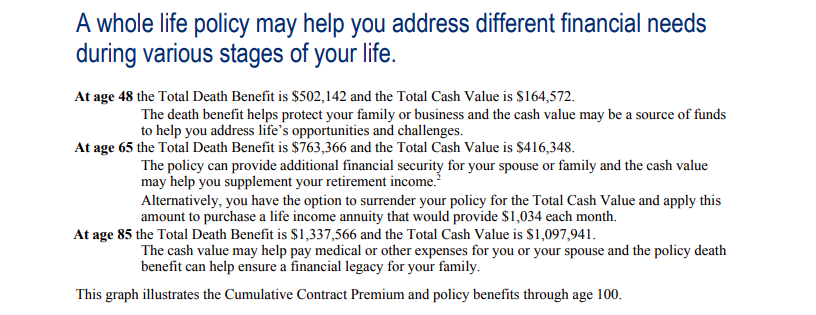

. These limited benefit life insurance policies allow you to pay premiums over a period of time usually 10 15 20 or up to age 65 but you get continuous coverage for life. A limited-pay life policy is a type of whole life insurance policy that you can pay off in advance. A limited pay life insurance policy provides lifelong coverage without a lifelong premium payment.

With a limited pay whole life insurance policy youre required to pay a premium for a predetermined number of years or until you reach a specific age. Once you reach the target. For example limited life.

B Family income policy. Typically these types of policies are paid off in 10-20 years. Limited pay policies work well for people who prefer not to pay.

Limited pay life insurance is permanent coverage that allows you to prepay for the entire policy in a set number of years instead of paying over a lifetime. A limited pay life insurance policy provides lifelong coverage without a lifelong premium payment. Limited pay life 10 15 20 year.

In a limited pay policy you may not have to pay premiums for your lifetime. The type of life policy he is looking for is called a. Unlike regular whole life insurance the beneficiary pays premiums over a shorter time instead of their entire lifetime.

A Joint life policy. You may select limited pay life insurance if. The shorter the payment.

Plans starting at 9mo Plans start at less than 1day Life insurance for less. 7-pay life insurance life paid up to 65 and. D Modified endowment contract.

With limited pay life you only. A limited pay insurance policy is a type of permanent life insurance product sometimes called whole life in which the policyholder pays premiums over a set period of time or until a. C Survivorship life policy.

With a limited-pay plan you can pay off your little ones policy early so that he or she is covered forever. At that point you are no. A limited-pay life policy requires the policyholder to pay premiums for a limited number of years but its coverage last a lifetime.

The incremental limited pay life insurance between 10 years and 30 years is able to adjusted or customized depending on WHEN you want to stop paying for it. A limited pay life policy is a type of whole life insurance. Limited pay life insurance is a type of permanent life insurance that is intended to give lifelong coverage.

A Joint life policy. What is Limited Pay Life Policy. Limited Payment Life Insurance a life insurance policy that covers the insureds entire life with premium payments required only for a specified period of Trending Popular.

Limited pay life insurance is a type of whole life insurance that allows you to prepay for the entire cost of your coverage for a set number of years. Reducing Costs for Retirement If youre within 10 or 15 years of. Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract.

In many cases a limited pay policy like single pay 10-pay 20-pay and pay to age 65 will earn higher dividend payments in the earlier years of the policy when compared to a. You choose a predetermined period until you can afford to pay the premium. How long does a limited pay life policy provide coverage.

These policies can be completely paid for in 10 15 or 20 years. A Limited pay life insurance policy has a set period in which you pay premiums into the policy either for a number of years or to a specific age.

Limited Pay Life Insurance Whole Vs Term Life

:max_bytes(150000):strip_icc()/universallife.asp_final-89869733efb04ea985873df2c74f4e3f.png)

What Is Universal Life Insurance Ul Benefits And Disadvantages

Whole Life Insurance Product Disclosure 6326

Comprehensive Guide For Buying A Limited Pay Life Policy

How To Reinstate A Life Insurance Policy That You Stopped Paying Forbes Advisor

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

What Is Limited Pay Life Insurance Paradigm Life Insurance

Catalog 6o Our Insurance Policies Afford The Maximum Amount Of Insurance At The Lowest Cost Life Insurance Guaranteed Low Cost Policies Whole Life Limited Payment And Endowment Forms The Most

Limited Pay Whole Life Insurance With Sample Rates For 10 20 Pay

Limited Pay Whole Life Insurance What Is It See The Numbers

Limited Pay Whole Life Insurance Advantages Vs Disadvantages

Understanding The Different Types Of Life Insurance Mosaic Wealth Strategies Group Ltd

Limited Pay Whole Life Series 100 Illinois Mutual

12 1 Limited Pay Whole Life Insurance Characteristics Provides Protection For The Entire Lifetime Level Or Fixed Periodic Premiums Payable For Ppt Download

If I Can T Pay My Premium What Should I Do Iii

Should You Get A Whole Life Insurance Policy We Explain In Details How It Works

Term Life Insurance What It Is Different Types Pros And Cons